The Banking System ( for UPSC-IAS Exam)

- The Banking system of the country is the base of the economy and economic development of the country.

- It is the most leading part of the financial sector of the country as it is responsible for more than 70 % of the funds flowing through the financial sector in the country.

In the evolution of this strategic industry spanning over two centuries, immense developments have been made in terms of the regulations governing it, the ownership structure, products and services offered and the technology deployed. The entire evolution can be classified into four distinct phases.

- Phase I– Pre-Nationalisation Phase (prior to 1955)

- Phase II-Era of Nationalisation and Consolidation (1955-1990)

- Phase III-Introduction of Indian Financial & Banking Sector Reforms and Partial Liberalisation (1990-2004)

- Phase IV-Period of Increased Liberalisation (2004 onwards) (this topic we will discuss in advance part)

- Phase V- Period of Banking reform and merger (2016 onwards) (this topic we will discuss in advance part)

Before going in depth study with gumnaam baba style .. lets have a look about Banking Structure in India –

Means RBI is the PAPA ( BAAP) of all Banks

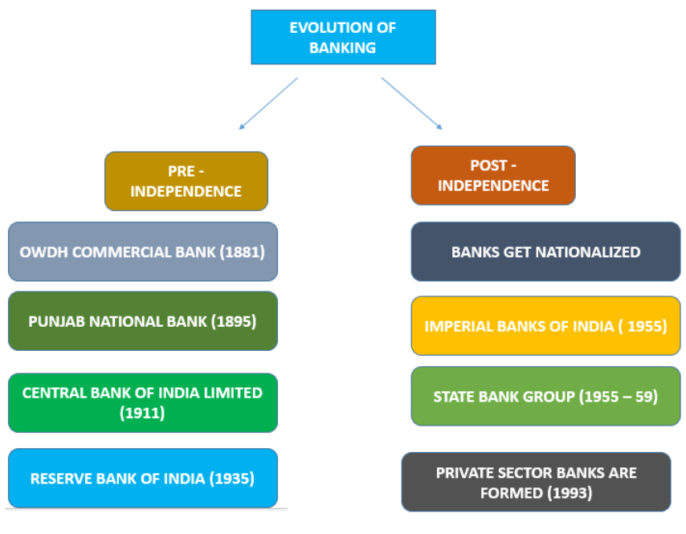

Evolution of Banking In Short

-

Phase I– Pre-Nationalisation Phase (prior to 1955)

Banking System of India

- India has a long history of financial intermediation. A type of business organization recognizable as managing agency houses took form in period from 1834 to 1847.

- Earliest of these was Hindustan Bank, established by one of the agency houses in Calcutta in 1770. Banking in India originated in the last decades of the 18th century.

- 1786 The General Bank of India

- 1790 Bank of Hindustan

But both are not in existence now.

The East India Company established,

1 1809 Bank of Bengal/Calcutta

2 1840 Bank of Bombay

3 1843 Bank of Madras

These three individual units were called as Presidency Banks.

The other banks during this period were,

- 1865 Allahabad Bank

- 1894 Punjab National Bank

- Between 1906 and 1913 Bank of India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, Indian Bank and Bank of Mysore

- In 1921, all presidency banks were amalgamated to form the Imperial Bank of India, was run by European shareholders.

- The Reserve Bank of India (RBI) was established on 1st April 1935, under the Banking Regulation Act 1934.

- After independence, the Government of India came up with the Banking Companies Act, 1949 later changed to Banking Regulation Act 1949 as per amending Act of 1965.

- RBI was vested with extensive powers for the supervision of banking in India as a Central Banking Authority.

-

Phase II-Era of Nationalisation and Consolidation (1955-1990)

- In 1955, Imperial Bank of India was nationalized and given the name “State Bank of India” (SBI), to act as a principal agent of RBI and it was established under State Bank of India Act, 1955.

- Seven subsidiary of SBI was nationalized in 1959.

SEVEN SUBSIDIARY AND MERGING

- State Bank of Patiala

- State Bank of Hyderabad

- State Bank of Travancore

- State Bank of Bikaner and Jaipur

- State Bank of Mysore

- State Bank of Saurashtra

- State Bank of Indore (Name not important)

- State Bank of Saurashtra in 2008 and State Bank of Indore in 2010, merged with SBI.

On 19th July, 1969, 14 major Indian commercial banks of the country were nationalized.

NATIONALISATION OF BANKS (1969)

- Central Bank of India

- Bank of Maharashtra

- Dena Bank

- Punjab National Bank

- Syndicate Bank

- Canara Bank

- Indian Bank

- Indian Overseas Bank

- Bank of Baroda

- Union Bank

- Allahabad Bank

- United Bank of India

- United Commercial Bank

- Bank of India ( Name not important)

In 1980, another six banks were nationalized with deposits over 200 crore and thus raising the number to 20.

NATIONALISATION OF BANKS (1980)

- Andhra Bank

- Corporation Bank

- New Bank of India (In 1993 merged with Punjab National Bank)

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Vijaya Bank (Name not important)

On the suggestions of Narasimhan Committee,( we have discussed ahead) the Banking Regulation Act was amended in 1993 and thus the gates for new private banks were opened.

- In 1971 Credit Guarantee Corporation was formed

- In 1975 Regional Rural Banks (RRBs) were formed.

- By the end of 1974, three separate institutional arrangements Commercial Banks, Cooperative Banks, RRBs were emerged.

- Establishment of National Bank for Agriculture and Rural Development (NABARD) in 1982 for cooperative credit.

Apart from NABARD,

- EXIM(Export-Import Bank of India) Agricultural Sector

- SIDBI(Small Industries Development Bank of India) Credit needs of small industries

- NHB(National Housing Board) Housing Board

- In 1988 Securities and Exchange Board of India was established to cater the security market in India.

- Since 1991, the Indian financial system has undergone radical transformation leads to the development of Non Banking Financial Companies (NBFCs) and Development Financial Institutions (DIFs).

- Competition has been infused into the financial system by licensing new private banks since 1993.

- The minimum capital of new Private Sector Banks should be Rs.300 crore.

These banks are

- PRIVATE SECTOR BANKS

- Axis Bank Ltd

- Development Credit Bank Ltd

- HDFC Bank Ltd

- ICICI Bank Ltd

- Industrial Bank Ltd

- Kotak Mahindra Bank Ltd

- Yes Bank Ltd ( Names not important)

In India the number of Foreign Banks is increasing in Private Sector and these banks will do all the commercial banking business.

FOREIGN BANKS IN INDIA

- A foreign bank with the obligation of following the regulations of both its home and its host countries. Loan limits for these banks are based on the capital of the parent bank, thus allowing foreign banks to provide more loans than other subsidiary banks.

- Foreign banks are those banks, which have their head offices abroad. CITI bank, HSBC, Standard Chartered etc. are the examples of foreign bank in India.

-

Phase III-Introduction of Indian Financial & Banking Sector Reforms and Partial Liberalisation (1990-2004)

- In order to improve financial stability and profitability of Public Sector Banks, the Government of India set up a committee under the chairmanship of Shri. M. Narasimham. The committee recommended several measures to reform banking system in the country.

Narasimham committee I

- There is no bar to new banks being set up in private sector.

- No treatment between public & private sector sectors.

- Asset reconstruction fund

- Recover bad debts through tribunals

- Branch licensing should be abolished

Narasimham committee II

- Rehabitalization of weak banks

- 2 or 3 large indian banks should be given an international character.

- Formulation of corporate strategy

- Capital adequacy

- Speed up of computerization & relationship banking

- Review the recruitment procedure

Raghuram Rajan committee(committee on financial sector reforms-2009)

- Macro economic framework and financial sector development

- Broadening access of finance

- Creating more efficient and liquid market

- Creating a growth friendly & regulatory framework

- Creating a robust infrastructure for credit.

हिन्दी

हिन्दी