The Hindu Editorial Summary

Editorial Topic : India’s Expanding Connectivity Projects

GS-2 Mains Exam : IR

Revision Notes

Question : Analyze the strategic importance of the IMEC project for India’s foreign policy. How does it align with India’s broader goals of enhancing connectivity and securing regional supply chains?

Chabahar Port Deal (May 13, 2024):

-

- 10-year agreement between India and Iran.

- Links India with Afghanistan and Central Asia.

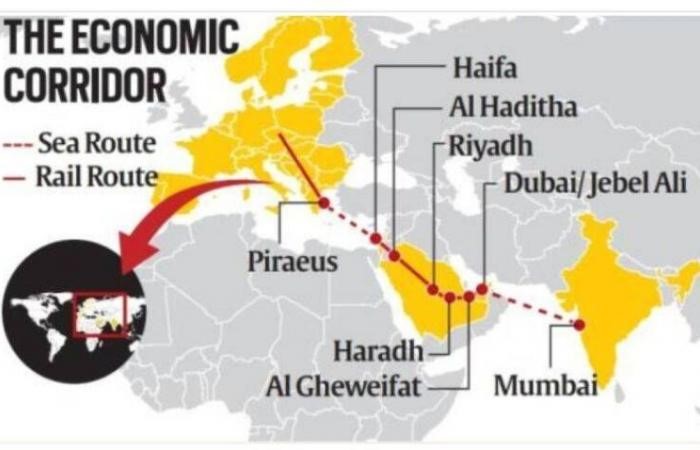

India-Middle East-Europe Corridor (IMEC) (Signed Sept 9, 2023):

-

- Initiated under the Partnership for Global Infrastructure and Investment (PGII).

- Aims for economic development through better connectivity between Asia, Middle East, and Europe.

- Two corridors:

- East: India to Arabian Gulf (ports like Kandla to Fujairah).

- North: Arabian Gulf to Europe (through Saudi Arabia, Jordan, Israel to ports like Haifa).

- Includes:

- Railway network for efficient goods and service movement.

- Undersea cables for electricity and digital connectivity.

- Pipelines for clean hydrogen export.

- Target: Secure regional supply chains, improve trade accessibility.

- Benefits:

- Reduce travel time and cost between India and Europe by 40% and 30% respectively.

- Seen as a counter to China’s Belt and Road Initiative (BRI).

- Major stakeholders include US, EU, France, Germany, Italy, UAE, and Saudi Arabia.

Impact of Gaza war on IMEC project:

- Announced in Sep 2023, IMEC project aimed to improve connectivity between Asia, Middle East and Europe.

- Gaza war (Oct 7, 2023) highlighted missing links in IMEC’s plan.

Issues with current plan:

- Red Sea Blockade: Houthi rebels blocked access for Israel and allies, forcing them to take longer Cape of Good Hope route.

- Strait of Hormuz Threat: Iran can potentially close the strait, disrupting oil and gas supplies as witnessed during 2019 Persian Gulf Crisis.

- Indian Navy had to launch ‘Operation Sankalp’ to ensure safe passage for Indian ships.

Missing Links:

- UAE ports are all in Persian Gulf, vulnerable to disruptions.

- Oman offers alternate route:

- Ports open into Arabian Sea, away from Iranian threats.

- Traditionally strong trade ties with India.

- Good relations with all stakeholders including Israel.

- Egypt as western connection:

- Major player in West Asia.

- Ports on Mediterranean Sea offer safe route to Europe.

Conclusion:

- Including Oman and Egypt strengthens IMEC against future conflicts.

- IMEC, if built on reconciliation triggered by Abraham Accords, can:

- Counter China’s BRI.

- Integrate the region.

- Mitigate threats to connectivity.

The Hindu Editorial Summary

Editorial Topic : RBI’s Record Surplus

GS-2 Mains Exam : Health

Revision Notes

Question : Explain the legal framework governing the surplus transfer from the RBI to the government as per the RBI Act, 1934 (Section 47). How does this framework ensure transparency and accountability?

Basic Concept : Part-1

RBI earns income in several ways:

- Interest from government securities: Just like you earn interest on bonds, RBI earns interest by holding Indian government bonds. (Example: If RBI holds a ₹100 crore bond with a 5% interest rate, it earns ₹5 crore annually).

- Open Market Operations (OMOs): RBI buys and sells government bonds to manage money supply. When RBI buys bonds, it injects money into the economy and earns interest on those bonds. (Example: RBI buys ₹100 crore of bonds from banks. The banks get cash, and RBI earns interest on the bonds).

- Foreign Exchange Operations: RBI buys and sells foreign currencies to stabilize the rupee’s exchange rate. Sometimes, these trades generate profits. (Example: RBI buys dollars when they’re cheap and sells them dearer later, pocketing the difference).

- Loans & advances: RBI lends money to banks in short-term situations. These loans come with interest. (Example: A bank might borrow ₹10 crore from RBI for a week at a 1% interest rate, paying ₹1 lakh in interest).

- Income from LAF (Liquidity Adjustment Facility): RBI provides short-term liquidity to banks through repo (buying government securities) and reverse repo (selling government securities) operations. These transactions generate income for RBI. (Example: A bank sells ₹100 crore of government securities to RBI through repo at 4% interest. RBI holds the securities and earns interest).

Basic Concept : Part-2

Reserve Bank of India (RBI) has various expenses to manage its operations:

- Operating Expenses: Salaries for RBI staff, electricity bills for offices, and maintaining its technology infrastructure.

- Interest on Deposits & Borrowings: If RBI accepts deposits from banks, it might pay interest on them. Also, RBI might borrow money to manage cash flow, incurring interest charges.

- Currency Issue Expenses: The cost of printing new rupees, transporting them to banks, and replacing worn-out notes. Imagine the cost of secure paper, high-quality printing, and secure delivery of new currency.

- Contingencies & Reserves: Funds set aside for unexpected situations. This could include potential losses from loans banks take out from RBI or economic downturns impacting the financial system. For example, RBI might need reserves to help banks facing a sudden surge in loan defaults.

Back to the Editorial

- RBI to transfer ₹2.11 lakh crore surplus to government (2023-24):

- Welcome boost for the new government’s budget in July.

- Reflects RBI’s prudent asset management during global uncertainty.

- Reasons for the high surplus:

- Higher interest income on overseas holdings.

- Gains from forex interventions to stabilize the rupee.

- Increased forex reserves (by $67.1 billion to $645.58 billion in a year).

- Income from Liquidity Adjustment Facility (LAF) operations.

- Surplus calculation based on Economic Capital Framework (ECF):

- Maintains a Contingent Risk Buffer (CRB) of 5.5-6.5% of the balance sheet for unforeseen events.

- Surplus is transferred to government only after risk provisioning.

- CRB includes provisions for monetary, financial, credit, and operational risks.

- Surplus transfer as per RBI Act, 1934 (Section 47).

RBI Income, Expenditure and Surplus

- Income:

- Interest from government securities, OMOs, forex operations, loans & advances, LAF.

- Expenditure:

- Operating expenses, interest on deposits & borrowings, currency issue expenses, contingencies & reserves.

- Surplus: Net income minus expenses, after reserves & contingencies.

Benefits:

- Increased provisioning (6.5% of balance sheet):

- Signals RBI’s confidence in domestic economy.

- Strengthens buffer against global financial risks.

- Bountiful surplus for new government (post-June 4 elections):

- Opportunity for increased capital spending.

- Bridge fiscal gap and reassure investors.

Conclusion: RBI lays the foundation for a confident start for the next government.

हिन्दी

हिन्दी