Prelims Exam

Revision Notes

Agriculture

1.Pradhan Mantri Fasal Bima Yojana (PMFBY)

Launched: 2016 by Ministry of Agriculture & Farmers Welfare

Objective:

- Provide financial support to farmers for crop failure due to natural calamities, pests, or diseases.

- Stabilize farmer income and encourage modern agricultural practices.

- Ensure credit flow to the agriculture sector.

Coverage:

- All farmers including sharecroppers and tenant farmers growing notified crops in notified areas.

- Crops covered: Food crops, oilseeds, and annual commercial/horticultural crops.

Premium Subsidy Sharing:

- Central and State Government share: 50:50 (90:10 for North-Eastern States)

- Jharkhand and Telangana likely to join, potentially increasing participating states to 22 for the Kharif season.

IR

2.India: Australia’s Top Tier Security Partner

Context

- Australia’s 2024 National Defence Strategy (NDS) designates India as a top security partner.

Deepening Defence Partnerships

- NDS prioritizes partnerships with key Indo-Pacific nations like India and Japan.

- The 2024 Integrated Investment Programme (IIP) outlines specific defence capabilities for Australia to invest in, aligned with the NDS goals.

Goals of Australia’s Defence Strategy

- Strengthen Australian Defence Force (ADF) capabilities for deterrence and warfighting in the Indo-Pacific.

- Build stronger partnerships with key countries, including India.

- Support India’s regional role through practical cooperation in areas like:

- Defence industry

- Information sharing

- Bilateral and multilateral cooperation

India-Australia Defence Relations

- Upgraded from “strategic partnership” (2009) to “Comprehensive Strategic Partnership” (2020).

- Numerous institutional mechanisms promote bilateral cooperation:

- High-level visits

- Annual Prime Ministerial Meetings

- Foreign Ministers’ Framework Dialogue

- 2+2 Ministerial Dialogue (Defence & Foreign Affairs)

- Joint Trade & Commerce Ministerial Commission

- Defence Policy Talks

- Defence Services Staff Talks

- Many more

Focus Areas of Strategic Partnership

- Maritime security

- Counter-terrorism

- Regional stability in the Indo-Pacific

QUAD (Quadrilateral Security Dialogue):

- Informal strategic forum involving India, Australia, USA, and Japan.

- Promotes a free, open, prosperous, and inclusive Indo-Pacific region.

India-Australia Defence Cooperation Highlights

- Upgraded Secretaries’ 2+2 Dialogue to Ministerial level (2020).

- “Joint Guidance for the India-Australia Navy to Navy Relationship” (2021).

- Malabar Exercise (2020): India, USA, Japan, and Australia.

- AUSINDEX (Naval Exercise)

- Pitch Black Air Force Exercise (India’s first participation in 2018).

- Mutual Logistic Support Arrangement (2020).

- Defence Science & Technology Implementing Arrangement.

- Increasing interoperability through shared military platforms (C-17, C-130, P-8 aircraft, Chinook helicopters).

- Regular exchanges of military officials for training.

Conclusion

- India-Australia defence and strategic cooperation has grown significantly in recent years.

- Australia’s NDS emphasizes continued support for India’s regional role and deeper defence cooperation.

- This partnership is driven by a shared perception of China’s growing threat.

Economy

3.Net Direct Tax Collections Surpass Target in 2023-24

Context

- India’s net direct tax collections reached ₹19.58 lakh crore in 2023-24, exceeding targets.

Target vs. Achievement

- Budget Estimates (BE) for Direct Tax revenue in FY 2023-24 were ₹18.23 lakh crore.

- Revised Estimates (RE) were fixed at ₹19.45 lakh crore.

- Provisional Direct Tax collections exceeded:

- BE by 7.40%

- RE by 0.67%

Direct Tax Collection Highlights

- Net collections (provisional) for FY 2023-24: ₹19.58 lakh crore (up 17.70% from FY 2022-23).

- Gross collections (provisional) for FY 2023-24: ₹23.37 lakh crore (up 18.48% from FY 2022-23).

- Refunds issued in FY 2023-24: ₹3.79 lakh crore (up 22.74% from FY 2022-23).

Breakdown by Tax Type

- Corporate Tax

- Gross collection (provisional) in FY 2023-24: ₹11.32 lakh crore (up 13.06% from FY 2022-23).

- Net collection (provisional) in FY 2023-24: ₹9.11 lakh crore (up 10.26% from FY 2022-23).

- Personal Income Tax (including STT)

- Gross collection (provisional) in FY 2023-24: ₹12.01 lakh crore (up 24.26% from FY 2022-23).

- Net collection (provisional) in FY 2023-24: ₹10.44 lakh crore (up 25.23% from FY 2022-23).

What are Direct Taxes?

- Levied based on an individual’s ability to pay.

- Aim to redistribute wealth within the country.

Types of Direct Taxes

- Estate Tax (Inheritance Tax)

- Income Tax

- Wealth Tax

- Corporate Tax

- Capital Gains Tax

Science and Tech.

4.Aditya-L1: India’s First Mission to Study the Sun

Mission Overview

- Launched by ISRO on September 2, 2023 (PSLV-C57).

- First Indian observatory dedicated to solar study.

- Continuously sending valuable data about the Sun.

Why L1?

- Aditya-L1 is positioned at the L1 Lagrange Point of the Sun-Earth system.

- L1 offers advantages over Low Earth Orbit (LEO):

- Smoother Sun-spacecraft velocity change for helioseismology.

- Location outside Earth’s magnetosphere for solar wind and particle sampling.

- Unobstructed, continuous Sun observation and Earth view for communication.

Scientific Payloads (7 Total)

- Remote Sensing (4):

- Visible Emission Line Coronagraph (VELC): Studies corona, coronal mass ejections.

- Solar Ultraviolet Imaging Telescope (SUIT): Images photosphere and chromosphere, measures solar irradiance variations.

- Solar Low Energy X-ray Spectrometer (SoLEXS) & High Energy L1 Orbiting X-ray Spectrometer (HEL1OS): Study solar X-ray flares.

- In-situ Observation (3):

- Aditya Solar Wind Particle Experiment (ASPEX) & Plasma Analyser Package For Aditya (PAPA): Analyze solar wind particles (electrons, protons, energetic ions).

- Advanced Tri-axial High Resolution Digital Magnetometers: Study interplanetary magnetic field at L1.

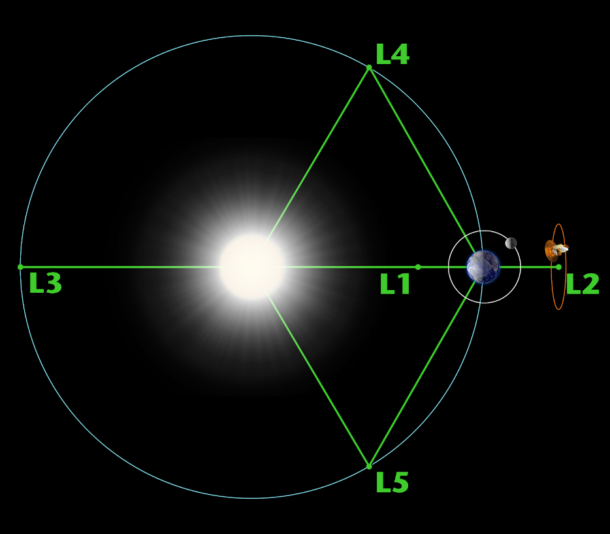

Lagrange Points Explained

- Lagrange points (L1-L5) are special positions where the gravitational pull of two large objects (e.g., Sun and Earth) balances the centrifugal force acting on a smaller object.

- L1 is an unstable point but ideal for continuous Sun observation (also used by SOHO satellite).

Geography

5.Ross Ice Shelf: Surprising Movements

- Largest ice shelf in Antarctica (size of France).

- Located in Ross Sea, extending into Southern Ocean.

- Named after explorer Sir James Clark Ross (19th century).

Sudden Jumps

- Researchers discovered twice-daily jumps in the ice shelf.

- Movement caused by pressure between ice sections, similar to tectonic plates.

- This friction may trigger icequakes (seismic disturbances in ice).

Environment

6.Ethylene Oxide in Spices: Safety Concerns

What is Ethylene Oxide (EtO)?

- Highly reactive gas used as a food fumigant.

- Kills bacteria, viruses, and fungi to prevent contamination.

- Flammable, colorless gas with a sweet odor.

Health Risks

- Carcinogenic (cancer-causing) with long-term exposure.

- Mutagenic (alters DNA) if inhaled.

- Reproductive health risks at high concentrations.

Recent News

- Singapore recalled Indian spice products due to alleged EtO presence.

- This highlights a potential gap between Indian production standards and international import requirements.

7.World Earth Day: Celebrating Our Planet

What is World Earth Day?

- Celebrated annually on April 22nd.

- A global event raising awareness about environmental sustainability.

Origins

- Emerged in the late 1960s amidst growing environmental concerns.

- First celebrated on US campuses in 1970 (following a major oil spill).

- Today, mobilizes over a billion people in 192+ countries.

Themes

- Focus on different environmental issues each year.

- 2024 theme: “Planet vs. Plastics”

- Highlights the dangers of plastic pollution on our planet and health.

- Calls for an end to plastic waste, demanding a 60% reduction in plastic production by 2040.

हिन्दी

हिन्दी